Home » SAFE — For Investors » MyScripts

MyScripts

Optimizing pharmacy workflow allowing pharmacies to proactively deliver personalized care.

HealthTech

Pre-Seed

RM250,000

Minimum Target

RM300,000

Maximum Target

RM5,000

Minimum Per Investment

RM2,800,000

Valuation Cap

20%

Discount

12 March 2024

Deadline

Campaign is Completed

Summary

- Product designed by pharmacy-owner team with deep industry knowledge, 80% complete

- First-mover in a large market.

- At expected traction, likely to be VC-ready in 12-18 months exceeding valuation cap of RM2.8m.

About

- MyScripts was founded in Sarawak by two US-trained pharmacists.

- It is a web application that allows pharmacists visibility and control over patients’ medications, and improves pharmacy workflow and efficiency allowing pharmacies to deliver patient-centric care.

- The venture took off in the Ideakita competition by MDEC in 2022, in which it won 2nd runner up out of 350 startups.

Team

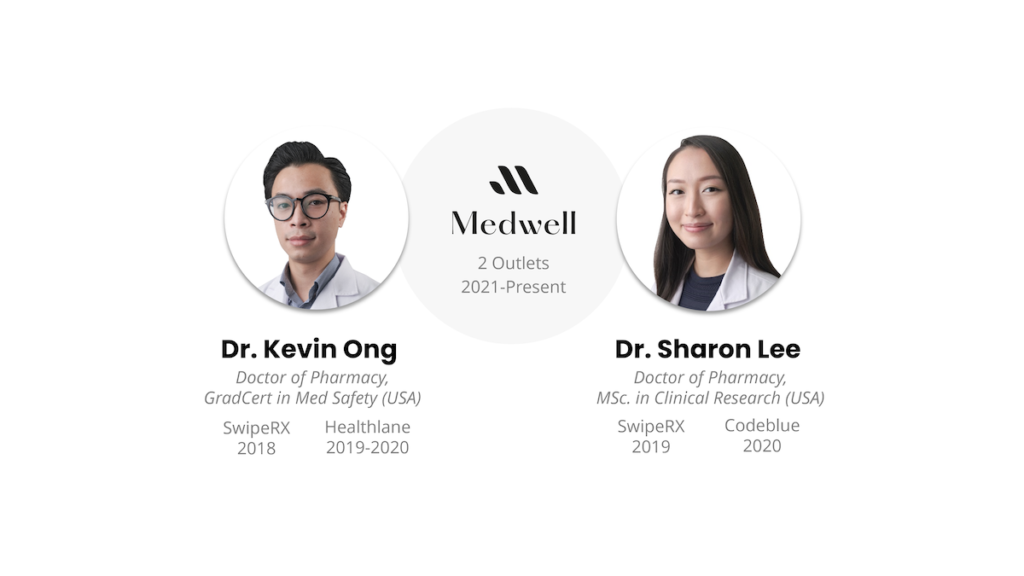

- Dr’s. Kevin & Sharon are a husband-and-wife team, who are both US-trained pharmacists that both previously worked in SwipeRX a tech platform that was a all-in-one app for pharmacists.

- Since then, they started their own retail pharmacy in Sarawak which expanded to 2 outlets.

- They experienced the pain points here first hand in their own practice, and could not find any solutions in the market, prompting them to use their tech experience to build something.

Problem & Solution

Dr’s. Kevin & Sharon realized that the problems that they faced in their pharmacies were also faced by other pharmacies and their patients.

Patients

Problem

Complexity of managing multiple meds on their own with limited health literacy

- Meds run out before patients can remember to refill risking out-of-stock situations at pharmacies and missing doses

- 1 in 3 adults have low health literacy

- Not knowing what meds they are on and how/when to take it

- Affordability due to lack of knowledge on generic meds

- Incomplete or missing meds records at various points of care

Solution

Continuity and safety of their med regimen powered by MyScripts

- Refills are ready for patients before they run out

- Improved med safety with tools such as drug-interaction checker

- Improved health literacy with layman terms and automated labelling

- Generic drug recommendations to save cost

- Complete med record bridges the gap in transition of care

Independent Pharmacies

Problem

Lack of clinical tools and are overloaded with administrative tasks

- Relying on patient recall or digging through purchase history to find patient meds

- Inability to predict inventory needs causing over- or understocking situations

- Time consuming manual ordering from suppliers

- Incomplete drug reference tool jeopardizing patient safety

Solution

Workflow optimization and visibility into patient med management

- Refill overview for patient medications

- Streamlined inventory replenishment through analytics and built-in procurement system

- Automated med labeling and refill reminder notifications

- Comprehensive drug reference tool

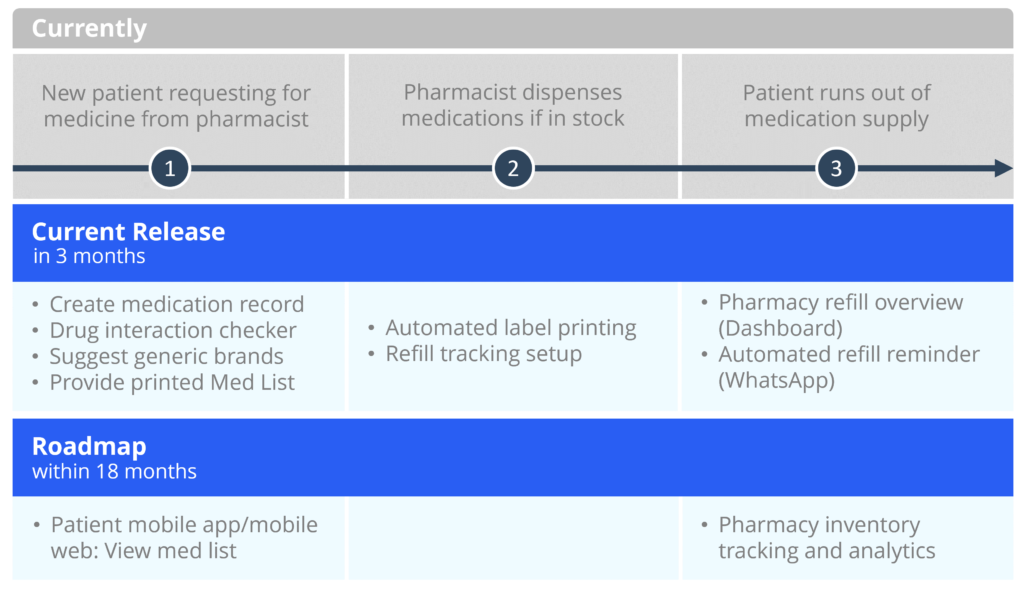

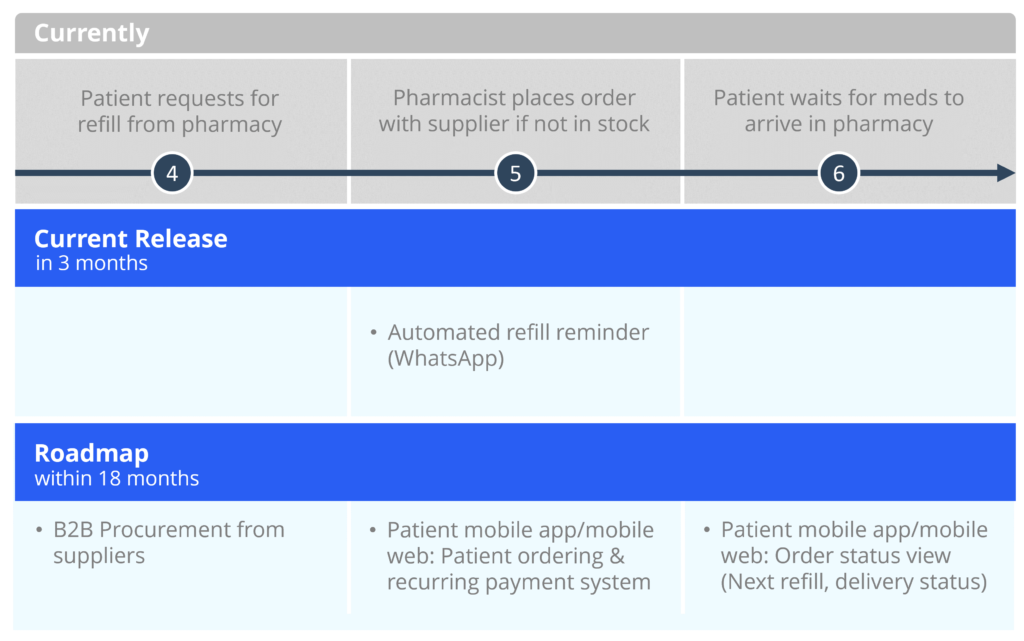

Product Features (by Release)

The current release of their application is 80% completed and will be launched in 3 months after the fundraising is completed. Subsequent features to be developed within the next 18 months have been confirmed.

Revenue Model

There are three sources of revenue for MyScripts.

Pharmacies’ Subscription (SaaS-based)

- Freemium Model to attract users by demonstrating value, restricting number of records as well as specific functionality.

- Paid access charged at RM199 / pharmacy / mth

- At 18 months, an expected 50% of customers will be paying customers.

1% of medication purchase

- Charged to patients as 1% of their purchases.

- Kicks in after the launch of the patient mobile app which will enable (recurring) payments.

1% of supplier ordering

- Create a B2B ordering feature where pharmacists can select orders, and automatically route them to suppliers.

Market Size

- MyScripts’ eventual market is Southeast Asia.

- It will start with independent pharmacies as chains could become competitors.

- The sizing here was done based on public data sources, and RM 199 per pharmacy per month, a 1% of medication purchase fee, and a 1% supplier ordering fee.

Total Addressable Market (TAM)

RM 460m based on 120,000 pharmacies in Southeast Asian countries lacking in dispensing separation

Serviceable Addressable Market (SAM)

RM 300m excluding chain pharmacies in Southeast Asia

Serviceable Obtainable Market (SOM)

RM 3m based on 2,500 independent pharmacies in Malaysia

Traction

- MyScripts’ current release is only 80% completed but is already being piloted in five independent pharmacies and one pharmacy chain with positive outcomes.

- These are the founders’ two pharmacies, and three independent pharmacies from two other brands (JB and KL).

Pilot Outcomes

50%

reduction in time required to manage patient refills

100%

of customers came back for monthly prescription refills

3x

numbers of customers with multiple daily medications

Competition

- MyScripts is a first mover in its category.

- Other systems used in pharmacies such as Point-of-Sale Systems and e-Prescription Systems do not serve the same function as MyScripts, i.e. CRM and workflow support.

Go-to-Market Plan

- MyScripts’ expected traction in 18 months’ time is 300 pharmacies on a paid plan, which will equal to an ARR of RM 716,400.

- They intend to achieve this using the following strategies.

1. Physical Flyers

• Mail out a flyer to every independent pharmacy in Malaysia to try the freemium system.

2. Partnership with e-Prescription Systems

• Tap into their existing pharmacy customers.

• Referrals commission.

3. Pharmacist Associations

• Provide MPS members discounts on MyScripts membership.

• Marketing channel (e.g. EDMs, socmed).

4. Pharmacy Alliances

• Provide group discounts on MyScripts membership.

5. Digitalization Matching Grants

• Allows pharmacies to get a discount without affecting MyScripts revenues and margins.

6. Trade Shows / Events

• Talks and conference booths at national pharmacy conferences.

Fundraising

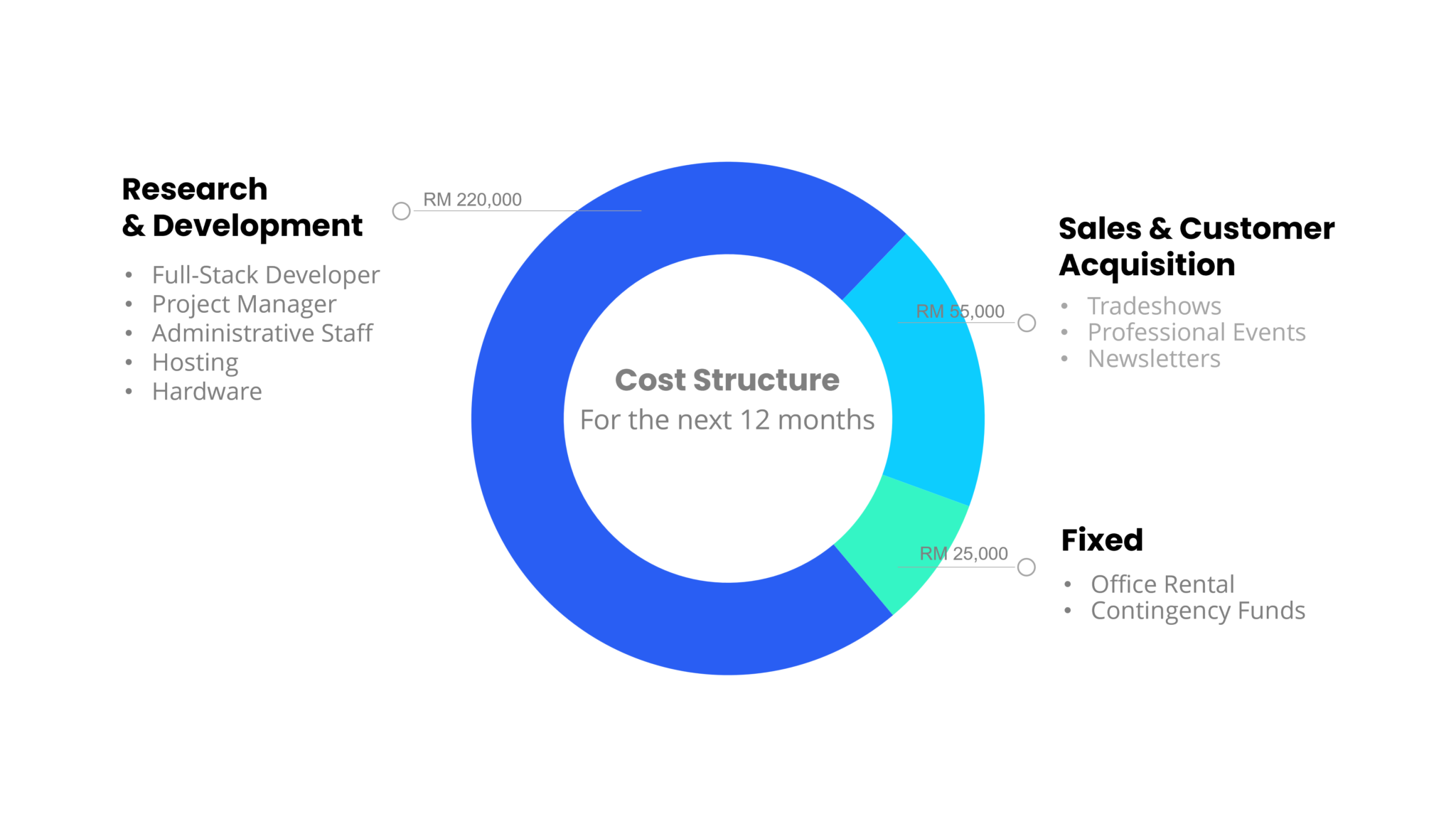

- The fundraising will mostly be used to complete the 18-month product development plan as well as customer acquisition.

- MyScripts is looking to raise up to RM 300,000 in this SAFE round.

- It will be at a discount of 20% and a valuation cap of RM 2.8m.

- The use of funds will be as follows:

Expected Conversion

- MyScripts expects conversion to occur at between 12-18 months, when its product development and customer acquisition is finished.

- Conversion is expected to be via VC funding.

Conversion Risks

Risks that the conversion may not occur are outlined as follows.

Customer Acquisition

• Pharmacies may resist getting MyScripts because they are worried about customer data being shared with a “competitor”.

Supplier Acquisition

• Inability to onboard suppliers to the B2B procurement system, leading to loss of supplier ordering revenue.

Patient Adoption of Mobile App / Mobile Web

• Elderly patients may not be technologically savvy.

• However, pharmacists will be able to provide reminders and use printouts instead.

Regulations

• Lack of regulations considering no such systems exist

• Mitigate risk by staying compliant with PDPA and HIPAA in design of system