INVESTMENT

Simple Agreement for Future Equities (SAFE)

Deals » What is a SAFE?

What are SAFEs?

SAFEs are a type of investment contract that stands for “Simple Agreement for Future Equity”. They were created by Y Combinator in Silicon Valley. SAFEs allow you to fund startups in exchange for the right to receive equity in the future, under certain conditions.

When you invest in a startup using a SAFE, you are not buying any shares of the company at that time. Instead, you are agreeing to receive shares in a later equity round, based on the amount you invested and the terms of the SAFE.

What determines the returns of a SAFE to an investor?

The returns of a SAFE to an investor depend on two main factors:

- The amount you invested: This is the initial capital that you provide to the startup in exchange for the SAFE. The more you invest, the more equity you can potentially receive in the future.

- The terms of the conversion: These are the conditions that specify how your SAFE will be converted into equity, based on what’s called the valuation cap and the discount (see below). These are mechanisms that protect your investment from being diluted by subsequent financing rounds. If there is both a valuation cap and a discount, the term that is more favourable to you will apply.

What is a valuation cap?

A valuation cap is a maximum valuation of the company at which you can convert your SAFE into equity. It means that if the company raises money at a higher valuation than the cap, you will still get shares at the valuation cap price.

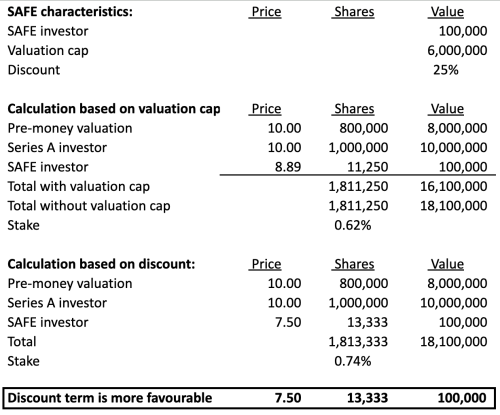

Valuation caps are stated as pre-money, whereby the company’s capitalization excludes the amount raised by the SAFE and other convertible securities. The lower the valuation cap, the more equity you will receive. If there is both a valuation cap and a discount, the term that is more favourable to you will apply. See below for an illustration.

What is a discount?

A discount is a percentage reduction in the price per share that you will pay compared to other investors in the equity round. It means that you can buy shares at a lower price than what others pay at the next priced round (when a trigger event occurs). Therefore, the higher the discount, the more equity you will receive. If there is both a valuation cap and a discount, the term that is more favourable to you will apply. See below for an illustration.

Provide an illustration of valuation cap and discount.

What are the main trigger events for a SAFE and how do they affect my investment?

A trigger event is a situation that causes your SAFE to convert into equity shares of the company. Under a 1337 Ventures SAFE, you will receive equity shares at the first trigger event that occurs, and you cannot choose to get cash instead. The three main trigger events in our agreements are:

- Equity financing: This is when the company issues new shares to raise more capital. The company may set a minimum threshold for it to apply, for example, the conversion will only happen if the company raises at least USD 3 million. The company may also exclude certain types of funding, such as grants or accelerator programs. When the conversion happens, you will get shares at the same price as the new investors, but with some adjustments based on the valuation cap and discount (see above).

- Liquidity event: This is when the company undergoes a major change, such as (a) being acquired by another company, (b) selling most or all of its assets, (c) merging with another company, or (d) going public (IPO). This does not include changes that only affect the legal structure of the company, such as moving to a different country or creating a holding company. When the conversion happens, you will get shares at the price determined by the company.

- Insolvency event: This is when the company becomes unable to pay its debts or goes out of business. If this happens, the company must immediately pay you back the amount you invested. If there are insufficient funds to pay you back, all available funds will be distributed amongst investors in proportion to their investment amounts, with any shortfall converting into Conversion Shares at a price determined by the company.

If none of these events happen, your SAFE may not convert into equity and you may not get any return on your investment.

What are the benefits of SAFEs?

SAFEs have some advantages for you as an investor compared to other forms of early-stage financing. Some of the benefits are:

- Quicker access to early-stage investments. With only a few key terms to negotiate and a standard format, investors can use SAFEs to quickly invest in promising startups.

- Potential equity at favourable terms. Upon the company being assigned a valuation in a priced equity round, SAFE holders convert their investment into equity. SAFEs can also include economic protections such as discounts and valuation caps, which can lower the effective price per share for SAFE holders.

- Priority over stockholders in case of dissolution. Should the company dissolve, the SAFE holders get repaid out of the liquidated assets before stockholders get any distributions.

What is the process of investing in SAFEs via 1337 Ventures?

The process of investing in SAFEs via 1337 Ventures is as follows:

- Browse the available opportunities on the 1337 Ventures website. You will see the pitch page of each startup, with the amount committed and number of investors so far.

- Review the pitch page and download the SAFE agreement of the startup you are interested in. Make sure you understand the terms and conditions of the SAFE, as well as the risks and rewards of this type of investment. If you have any questions, you can contact 1337 Ventures for more information.

- Fill out the form on the pitch page, stating the amount you want to invest. You will need to provide your personal and contact details, as well as proof of identity and address for KYC purposes.

- Review and sign the SAFE Agreement we send you, and make your payment to the trust account of 1337 Ventures, which will hold your funds until the investment is completed. You will need to share your proof of payment with 1337 Ventures as evidence of your payment.

- If the campaign closes having met its minimum fundraise and the startups’ shareholder and director approval for entry into the SAFE has been obtained, the funds will be released from the trust account to the startup. If not, the trustee will return all of your monies to you.

- You will receive an e-statement of your investment, as well as a copy of your agreements electronically for your safekeeping.

Who can invest in SAFEs via 1337 Ventures?

1337 Ventures is a platform that enables angel investors and sophisticated investors only to invest in SAFEs of promising startups.

According to the Securities Commission Malaysia, the eligibility criteria for these types of investors are as follows:

- Angel Investors

Angel investors are individuals who meet at least one of the following criteria:- Net Personal Assets: Exceeding RM 3 million or its equivalent in foreign currencies, excluding the value of the individual’s primary residence.

- Annual Income: Gross annual income exceeding RM 180,000 or its equivalent in foreign currencies in the preceding 12 months.

- Joint Income with Spouse: Gross annual income jointly with their spouse exceeding RM 250,000 or its equivalent in foreign currencies in the preceding 12 months.

- Sophisticated Investors

There are three categories of sophisticated investors, for full details refer to SC guidelines on Sophisticated Investors.- Accredited Investor

• Accredited investors include entities like unit trust schemes, private retirement schemes, investment schemes, Bank Negara, licensed financial professionals, stock exchanges, approved clearing houses, and corporations approved to conduct regulated financial activities. It also includes directors or CEOs of these entities and closed-end funds approved by the Securities Commission Malaysia. - High-Net Worth Entity (HNWE)

• High-Net Worth Entities include companies or partnerships with assets over RM 10 million, public companies approved as trustees, fund managers for related companies, and statutory bodies or pension funds involved in capital market investments. These entities must meet specific financial thresholds and legal approvals. - High-Net Worth Individual (HNWI)

• High-Net Worth Individuals are people with total personal or combined assets over RM 3 million (excluding primary residence value beyond RM 1 million) or those earning over RM 300,000 annually (or RM 400,000 jointly with spouse or child). They can also qualify if they have an investment portfolio over RM 1 million, hold relevant degrees and professional memberships, or have five years of relevant finance or investment experience.

- Accredited Investor

Sophisticated investors must self-declare confirming that they satisfy the relevant criteria at the point of onboarding.

On 1337 Ventures, angel investors can invest a maximum of RM500,000 within a 12-month period, and sophisticated investors have no restrictions on investment amount.

Retail investors are individuals who do not meet the criteria of angel investors or sophisticated investors.

Retail investors are excluded from investing in SAFEs via 1337 Ventures because SAFEs are considered high-risk and high-reward investments that require a high level of financial literacy and risk tolerance. Retail investors may not have the necessary knowledge, experience, and resources to assess the potential and viability of the startups, as well as the terms and conditions of the SAFEs.

Interested to invest in a SAFE?

View existing & past deals