BLOG

Insights

Insights from Venture Capital to Startups, Investors & Corporates

- All

- 1337 Ventures

- Accelerator

- AI and ML

- Alpha Startups

- Corporate Innovation

- ECF Accelerator

- Equity Crowdfunding (ECF)

- Event

- Events & Programmes

- Fintech

- Hackathon

- HealthTech

- Insurtech

- Investments

- Islamic Fintech

- Leet Academy

- Leet Capital

- Leet Team

- Marketing

- Post Event

- Press Release

- Raise Funds

- Reports

- Startup Hacks

- Startup Stories

- Venture Capital

- Vertical

1337 Ventures, Malaysia’s pioneering venture capital firm and accelerator, is excited to announce its strategic investment in DesignPro, an AI-powered startup transforming

This year, we at 1337 Ventures were proud to serve as judges and ecosystem partners in Alliance Bank BizSmart® Challenge The Ultimate

Image source: EliteFit As healthcare systems face increasing challenges in scaling patient care, reducing costs, and improving treatment outcomes, innovative digital solutions

Image Source: BFM – Nebula: Taking Cloud Gaming to the Next Level 1337 Ventures, Malaysia’s early-stage venture capital firm, has announced its

On July 28, 2025, the second edition of Leet Launchpad lit up Microsoft Malaysia with an electrifying afternoon of startup pitches, investor

Enprivacy, a promising newcomer in the data security and AI governance domain, has secured funding from 1337 Ventures, Malaysia’s leading early-stage venture

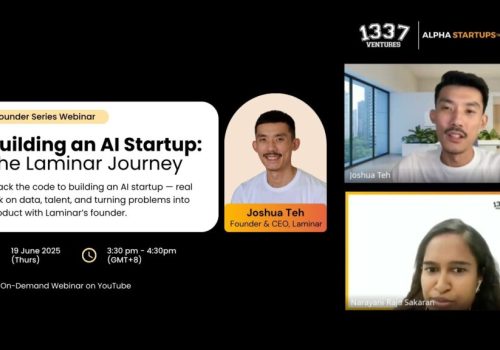

Are you an ambitious startup founder exploring the cutting-edge AI startup space? Whether you’re shaping a groundbreaking idea or diligently building

Every day, procurement teams worldwide waste hours manually reviewing vendor proposals, a tedious and error-prone process. For Malaysian enterprises, this inefficiency means

Are you an aspiring HealthTech startup founder exploring the dynamic HealthTech space? Whether you’re still shaping your idea or building your MVP,