STATE OF THE MALAYSIAN FINTECH ECOSYSTEM 2018

WE’VE UPDATED THIS LIST. DO CHECK OUR LATEST POST HERE: https://1337.ventures/malaysia-fintech-opportunity-map-version-1-1/

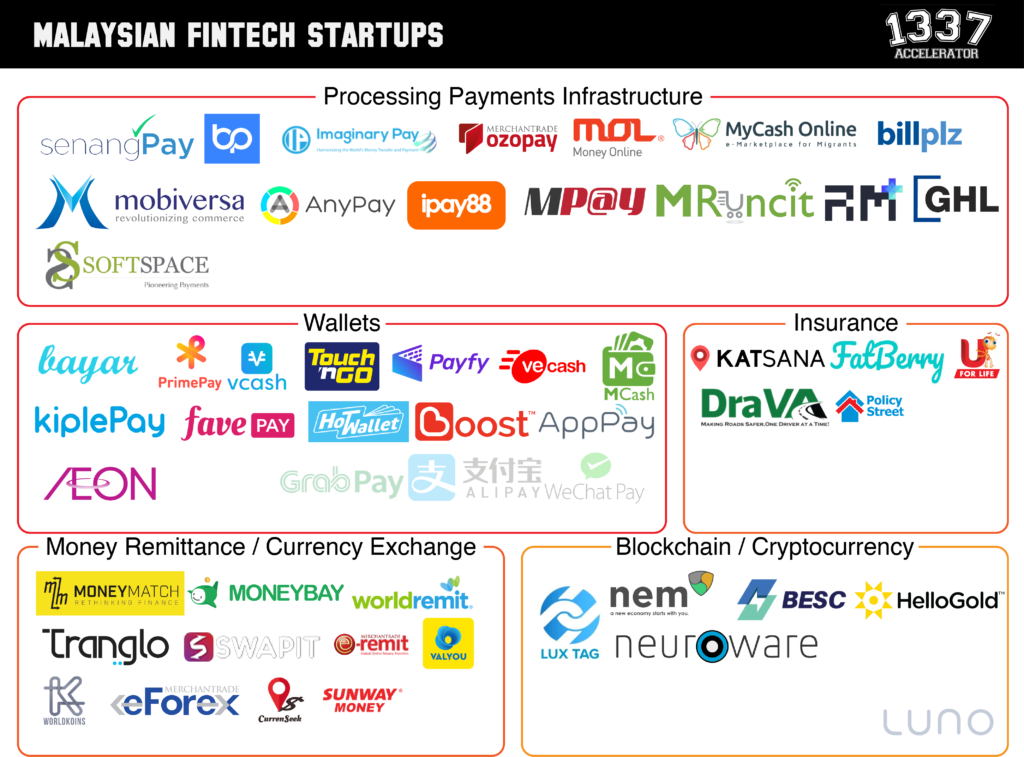

Presenting 1337 Ventures’ comprehensive 2018 list of Fintech Startup Players in Malaysia! Does it seem bare? Do you know any Fintech startups we’ve missed out? We’d like this diagram to be as collaborative as possible. So if you know of any Fintech players that are not in this diagram yet, tag them in, or submit a form here!

This diagram segments Malaysian Fintech startups into various industries to give you a better look at the state of the Fintech industry in Malaysia. For example, from a brief glance, one can see that the “Wallet” market is very crowded, compared to a less popular vertical such as “Credit Scores and Analytics”. If you’re interested in entering the Fintech space, do refer to this diagram first as a starting point before making any costly decisions. Factor in: who are your competitors? Is your space currently crowded? Who are the major players and partners that you could possibly collaborate with? By curating this list, we hope that it helps you answer these pertinent questions.

Interested in tackling the problems in some of these sectors but don’t know how to start? Think you have a game-changing solution that can fill up the gaps in our Fintech ecosystem? Join us for our ‘State Of The Fintech Ecosystem’ Talk on the 11th of June, followed by a Fireside Chat with startup founders. Gain exposure to the Fintech ecosystem and come pitch your idea to us live at the event! Apply for the Talk-cum-Pitch here: https://alphakl18.eventbrite.com/

As you can see, the first page is the most populated section. Some of you might be surprised to see this much variety of verticals! Isn’t Fintech just about wallets? We hate to break it to you; but it isn’t. In fact, there are 2 more pages covering different verticals in the Fintech space! It is no surprise that the “Wallet” Vertical is one of the Top 3 most competitive and crowded space, as many big corporates are releasing their own e-Wallets, Aeon being the latest to announce their wallet. Consumer-facing verticals tend to get more attention.

Obviously, blockchain and cryptocurrency is also on Page 1, as it is the most hyped topic in 2017/2018, with bitcoin dominating the buzz in this vertical. However, one should understand that blockchain / cryptocurrency are just means; they aren’t the end solution.

Now even though these sectors are already so packed, we think there’s still lots of room for growth! We’re excited to invest in Fintech startups as there are plenty of problems left to be solved in the financial services space. Check out some of the top Problem Statements that the banking sector are currently facing, submitted by our 3 bank partners, Maybank, RHB and Hong Leong Bank, on our Alpha Startups: Fintech Edition site.

In Page 2, one can see much more blank white space, as the verticals become less populated. “Comparison Sites” and “CrowdFunding” have some competition, but verticals such as “Real Estate” and “KYC” are occupied by only one player. Wait… Are you surprised to see only ONE startup in the “Personal Finance & Mobile Banking” vertical? Well, we are! Why are these important sectors so empty? Are you ready to fill the gap?

Finally, the last page. Even more bare! These are gold mines, which some hopefuls are trying to mine, but haven’t cracked the code or acquired the secret sauce. Yet! Do you think you could be THE chosen one? Meet us live on the 11th of June @ our State Of The Fintech Ecosystem Talk to pitch your idea to us (register on our EventBrite page), or alternatively, register directly for our Alpha Startups: Fintech Edition programme for the opportunity to get up to RM 125,000 in startup funding, mentorship, network with major financial services players, and more, at: bit.ly/alphafintech.

Feel free to fill up this form if you know of any fintech startups that are evidently missing here, and share this post if you wish to help grow this collaborative list!