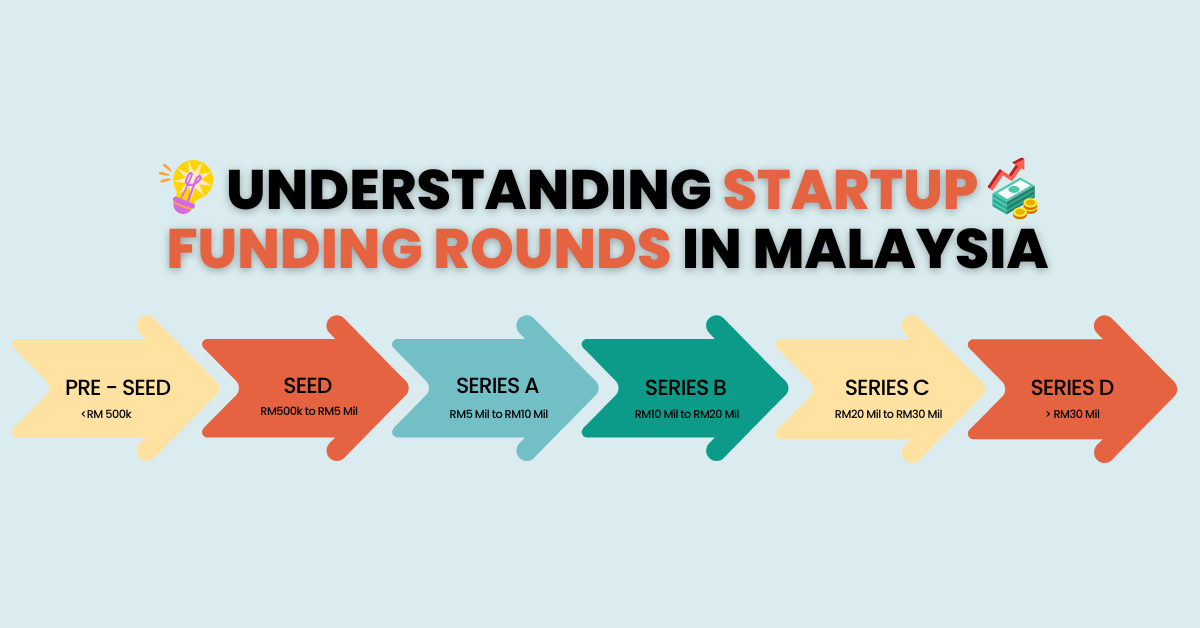

Startup funding rounds are crucial milestones in securing capital from investors. From pre-seed to Series B and beyond, each funding stage contributes to the growth and development of your startup. The funding duration can range from as little as 3 to 18 months.

In this article, we will provide a breakdown of each funding stage and discuss what to expect, from the initial pre-seed stage to the advanced Series D round.

The Pre-Seed Stage

At the pre-seed stage, startups are in the early phases of development. Founders spend their time conceptualizing ideas, conducting market research, and building a minimum viable product (MVP). Typically, pre-seed funding covers initial expenses related to prototype development. Funding for this stage can come from various sources, including early-stage venture capitalists, angel investors, bootstrapping, and friends and family. On average, pre-seed funding amounts range below RM500k.

The Seed Stage

The seed stage follows the pre-seed stage, marking a transition into product development and early revenue generation. To secure seed funding, startups must demonstrate signs of market or product fit. Sharing monthly revenues can showcase growth potential and scalability. Angel investors, friends and family, and bootstrapping are common sources of seed funding. Funding in the seed stage typically ranges from RM500k to RM5 million.

Series A

Series A funding is obtained after successfully demonstrating substantial revenue growth and product-market fit. Startups at this stage should have a clear plan for long-term profitability and monetization strategies. Activities during Series A may include fine-tuning the product or service, marketing, branding, and team expansion. Venture capital firms are the primary investors during Series A, with funding typically ranging from RM5 million to RM10 million.

Series B

In the Series B stage, startups have proven market viability and are prepared for significant scaling. This stage often requires a larger capital investment to expand operations, meet customer demands, enter new markets, or enhance competitiveness. Funding in Series B generally falls between RM10 million and RM20 million, mostly by venture capitalists focused on later-stage startups.

Series C

Series C funding is characterized by exponential growth and consistent profitability. Startups at this stage are ready to explore new markets, develop additional products, or even consider acquisitions. Investors at this stage include private equity firms, banks, and hedge funds, with funding typically ranging from RM20 million to RM30 million. Series C is often the final funding round, though some startups may proceed to Series D or beyond.

Series D

Series D, also known as the bridge stage or pre-IPO stage, serves to further expand the business, prepare for an initial public offering (IPO), or position the company for acquisition. Existing investors may choose to sell their shares, allowing larger investment opportunities from institutional investors, private equity firms, or hedge funds. Series D funding typically involves a minimum of RM30 million.

READ ALSO: A 2023 Guide To Startup Funding in Malaysia

To sum it up

Understanding funding rounds is vital for startups. It helps identify the right Venture Capital firms (Early or Late Stage) to approach based on your journey and funding needs. Each funding round is a milestone, reflecting unique growth. Finding the right Venture Capital partner increases fundraising success and maximizes growth opportunities.

If you are ready to pitch, join our open pitch session known as Pitch Tuesday, where we listen to early and growth stage Southeast Asian startups pitch. To join, submit your details at https://1337.ventures/pitch-tuesday.