1337 Ventures and Minister of Finance YB Tuan Lim Guan Eng and Securities Commission Malaysia Chairman Datuk Syed Zaid

1337 Ventures and Minister of Finance YB Tuan Lim Guan Eng and Securities Commission Malaysia Chairman Datuk Syed Zaid

1337 Ventures is proud to announce that we are one of the three new recipients of the Equity Crowdfunding (ECF) license by the Securities Commission. The official announcement took place today, the 17th of May, 2019.

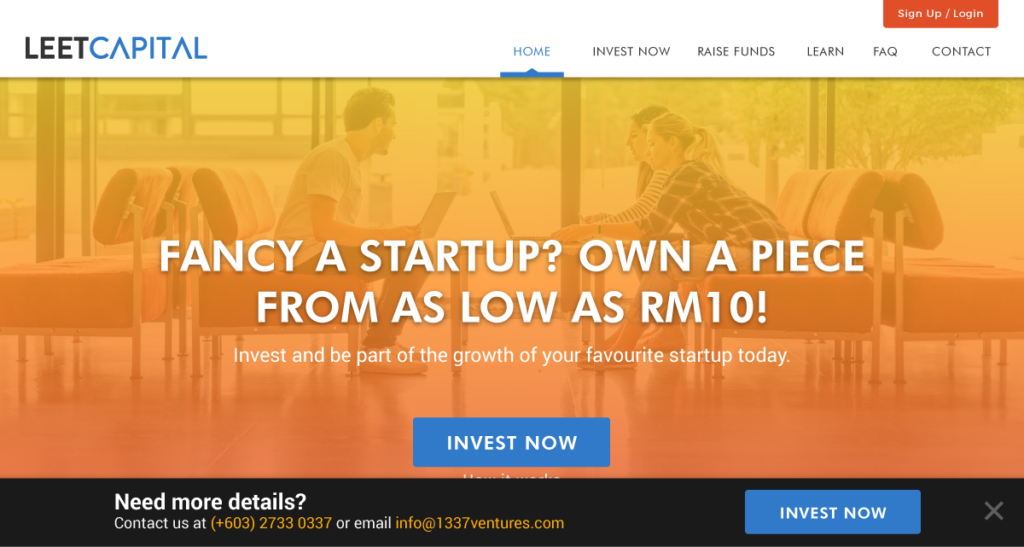

As one of the newly recognised market operators, together with MyStartr, a chinese-oriented crowdfunding platform, and Ethis Ventures, a shariah-compliant focused platform, 1337 Ventures will be launching their platform, Leet Capital, to the public in Q4 of this year.

A Statement from Bikesh Lakhmichand, Founding Partner of 1337 Ventures

“We aren’t going out of our purview by joining the equity crowdfunding (Leet Capital) scene; it’s a natural progression for us. It fits into the funnel we’ve been crafting and have planned since we first started 1337 Ventures as Malaysia’s first tech accelerator. From our track record, many angel investors, together with our corporate partners/clients, were keen to invest with us, and that started the ball rolling. We believe that we’ll stand out from the rest by leveraging off our track record and our accelerator programme, Alpha Startups, and also by providing the correct base and clear continuation to each startups, increasing the success rate of each startups offered to the public.”

Unfair Advantage

As mentioned, 1337 Ventures will be levelling the playing field. From past observation and research, most operators agree that there are three challenges they face: lack of quality startups, lack of investors, and bad public perception. 1337 Ventures, through its years of operation, has a different take to solve these problems.

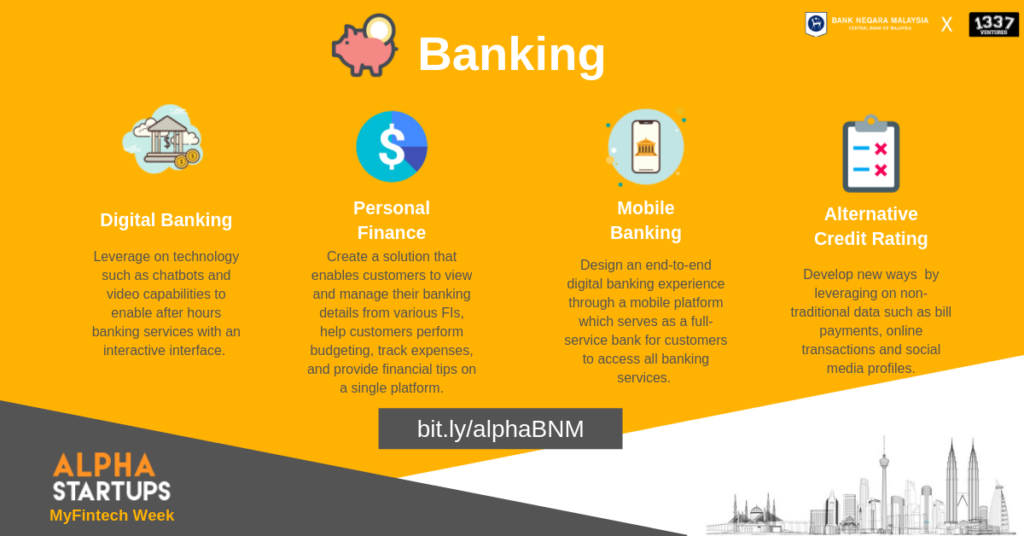

To solve the lack of quality startups in Malaysia, 1337 Ventures will do what it does best for the past 7 years; by creating quality startups. Through it’s Alpha Startups programme, a one-week intensive pre-accelerator, 1337 Ventures have churned our many of the top startups in the region, such as Funding Societies, Coins.ph, and AnyPay.

Among its many initiatives this year to democratise resources to assist startups in achieving greater heights, 1337 Ventures has developed Leet Academy, a fully-digitised version of its Pre-Accelerator programme. This programme doesn’t just function as a learning resource for startups, but also as a funnel to ensure that investors only gets the crème de la crème.

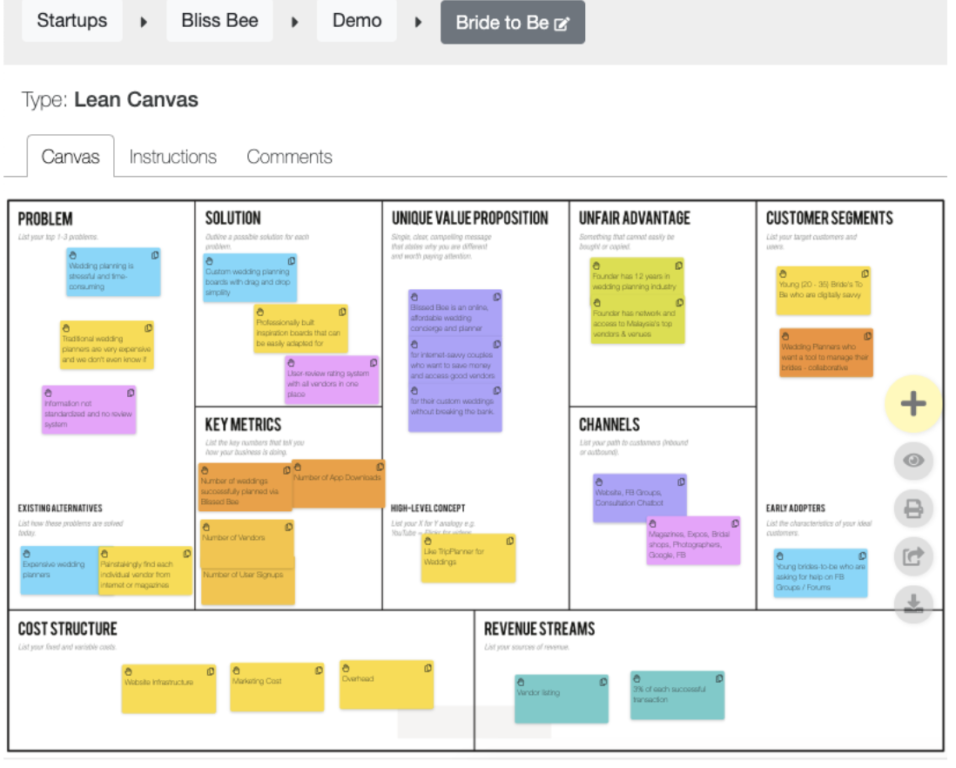

Preview of Leet Academy’s tools

Preview of Leet Academy’s tools

The tools aren’t just a digitalised version of our accelerator; it’s also a further refined product to help enhance the startups learning further than any brick-and-mortar programme can.

How is Leet Capital different?

1337 Ventures envisions that to shift ECF from the sideline into the mainstream market, it has to provide a slew of supplementary modules. Ranging from investor education to demystifying startup’s bad rep, Leet Capital has a few tricks up our sleeves to accomplish our goals.

1337 Ventures is aware that some of the top concerns from investors are the high-risk and lack of track record from the current companies listed on the ECF platforms. Part of what 1337 Ventures do is guide corporates, such as Naza, and SMEs through their innovation journey. After conducting design sprints with these corporates, 1337 Ventures help them identify and “start-up” new business units. These business units could then raise funds via Leet Capital, leveraging off the distribution and brand trust-worthiness of its parent company.

1337 Ventures recently concluded Malaysia’s first SME accelerator with CIMB Foundation, and have graduated 3 SMEs from a brick-and-mortar business, into a digitized business serving new customers. These three graduates could potentially be the first few issuers on Leet Capital.

Successful Alumni

As the first accelerator in Malaysia, Alpha Startups have successfully graduated top startups all over South East Asia. Some notable graduates of Alpha Startups are Funding Societies, who raised SG$10 Million from Sequoia Capital in under 12 months after completing Maybank Fintech (Alpha Startups) and is one of the top performing P2P lending platforms in Malaysia.

Most recently, Alpha Startups alumni, AnyPay, was acquired by Revenue Group Bhd. Others include Coins.ph, which was recently acquired by GoJek for $72 million, and MaidEasy, that raised an undisclosed 7-digit amount from Axiata 12 months after Alpha Startups.

Interested in investing or raising from Leet Capital? Click here to pre-register now!