This May, 1337 Ventures, in partnership with Bank Negara Malaysia, is launching their accelerator programme, Alpha Startups: MyFintech Week.

Problem Statements

We are currently looking for solutions solving pain points around the Insurtech, Payment, Cross-border, Regtech and Banking industry. Below are the pain points broken down and deconstructed:

Banking

Throughout the world, one of the fintech vertical being disrupted the most has been the banking industry, particularly lending. Not only is trust in banks plummeting, with trust in tech companies such as Amazon and Google being almost at the same level of banks, newer, better, and much more customer-centric solutions are popping up.

Throughout the world, one of the fintech vertical being disrupted the most has been the banking industry, particularly lending. Not only is trust in banks plummeting, with trust in tech companies such as Amazon and Google being almost at the same level of banks, newer, better, and much more customer-centric solutions are popping up.

With the rise of Neo and Challenger banks, banks are facing much more pressure to innovate. Neo-banks are stealing market share from existing banking customers, and even the unbanked population, through their innovative functions, intuitive design, and unparalleled customer experience.

With that in mind, the problem statements for the Alpha Startups: MyFintech Week revolves around the current customer pain points. With the rise of technology and the shift in customer behavior, digital banking solutions are one of the biggest pain points. How can one leverage off technology to provide unparalleled customer experience in a period where customers demand to be serviced anytime, anywhere?

It is oxymoronic that in the 21st century, with so much unconventional data points that collect customer behaviors, financial institutions are still yet relying on traditional, incomprehensive data sets to prove the credit worthiness of an individual. How can one utilize these unconventional data sets to provide a holistic view of an individual to devise an improved credit score?

Some successful startups in this industry consist of Monzo, valued at $1.5 billion, Revolut, valued at $1.7 billion, and Mint.com, acquired for $170 million. (I’ve linked some nice reads on these success stories; you’re welcome!)

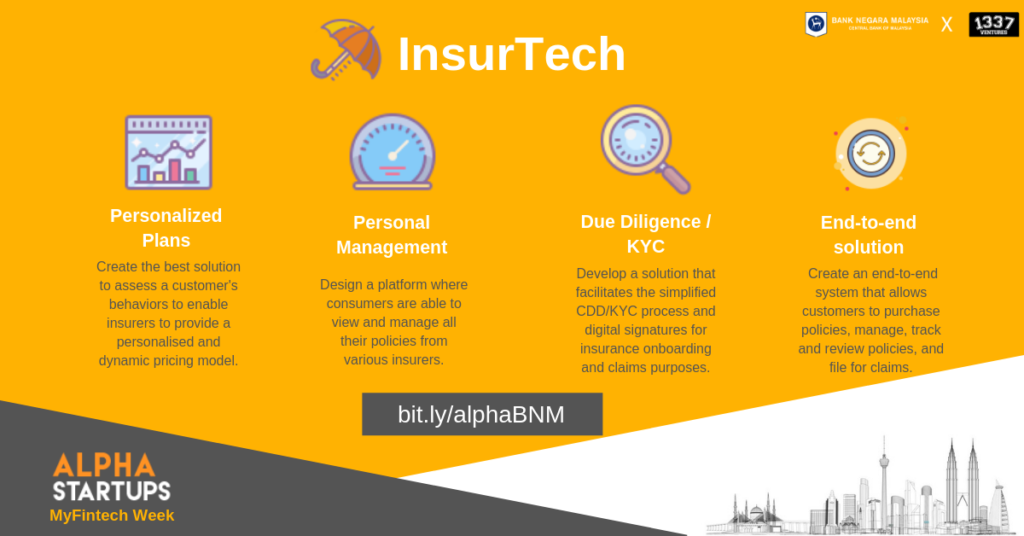

InsurTech

Insurance has remained much the same for many years and, due to a risk-averse culture, particularly resistant to change. Before the advent of new technologies, it wasn’t a competitive market where new players could easily enter. That’s all changing.

Insurance has remained much the same for many years and, due to a risk-averse culture, particularly resistant to change. Before the advent of new technologies, it wasn’t a competitive market where new players could easily enter. That’s all changing.

Just as how banking has been disrupted by new technology companies, Insurance has now become ripe for disruption by insurtech. Globally, Insurtech is growing at a CAGR of 16%, and just in Q1 2018, InsurTech startups raised nearly $1.2B.

Due to the shift in customer behavior to a much more instant gratification approach, insurance’s once “one size fits all” packages have been starting to fall out of trend. How can one design a personalised insurance package that caters to an individual’s needs and wants, producing a dynamic pricing model?

InsurTech is becoming the next big buzz word in the Fintech industry, and each day, new startups are popping up with new success stories, with some of the biggest being Lemonade that is valued at $2 billion for reversing the traditional insurance model, and Root Insurance, valued at $1 billion, that helps good drivers save money!

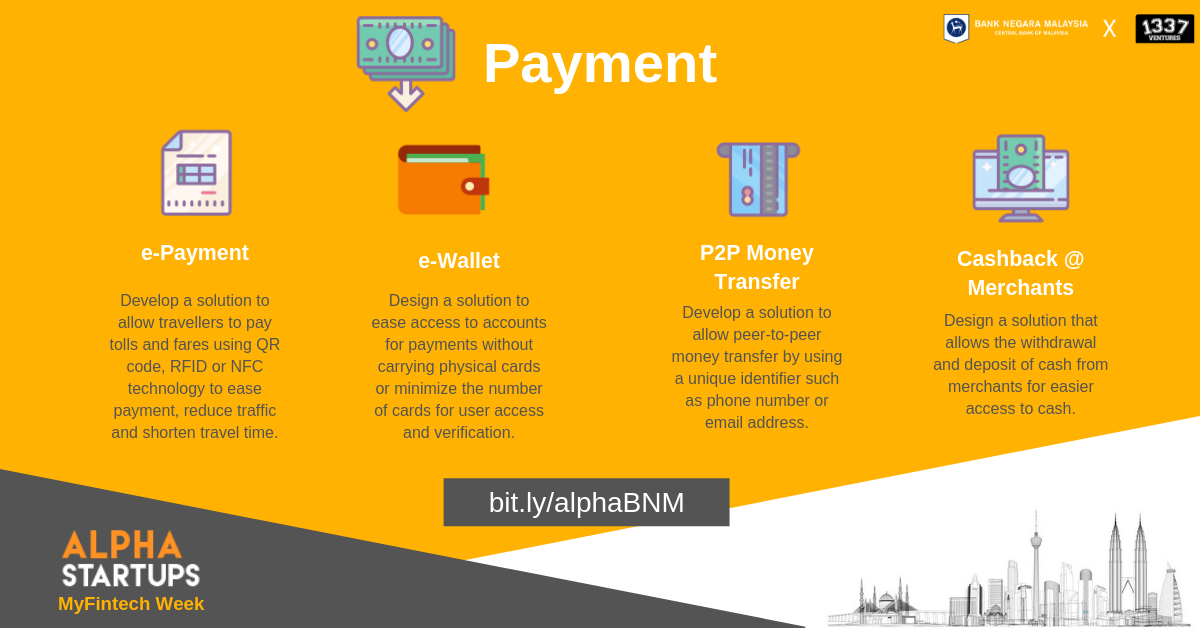

Payment

The Payment vertical is currently the most competitive one in Malaysia, with payments and wallets being the two largest representation in the Malaysian Fintech Scene (source: FintechNews.my) , standing at 19% and 17% respectively.

The Payment vertical is currently the most competitive one in Malaysia, with payments and wallets being the two largest representation in the Malaysian Fintech Scene (source: FintechNews.my) , standing at 19% and 17% respectively.

However, though representation is at large, there are still many pain points unaddressed in the market, ranging for easier payment solutions, or a unique identifier to speed up transfer process.

Though the trend towards digital payment is rising, it is difficult to see a totally cashless Malaysia in a short period of time. How can we create a solution that allows the user to withdraw and deposit money via alternative methods, as ATM queues tend to be a turn off to customers?

The transaction volume of payments in 2017 alone is at least RM 6.8 trillion. Some success stories around this field is Stripe, valued at $20 billion, and Square, valued at $32 billion.

Regtech

Regtech (Regulatory Technology) refers to technological solutions that streamline and improve regulatory processes. On the flipside, regulators are looking to utilize technology to monitor and enhance their capacity to cater not only to the rising amount of transactions, but to also parse the increasing amount of data points available in this day and age.

Regtech (Regulatory Technology) refers to technological solutions that streamline and improve regulatory processes. On the flipside, regulators are looking to utilize technology to monitor and enhance their capacity to cater not only to the rising amount of transactions, but to also parse the increasing amount of data points available in this day and age.

Invoice duplication and fraud cases in invoice financing can be mitigated by creating a database leveraging on a unique ID for each invoice/document. As for compliance checking, we’re looking for individuals to create a digital platform to help FIs perfom compliance checks and assist central banks to perform capital adequacy checks on each bank. Explore the possibility of features that facilitate exchange of digital signatures and document authentication.

Between 2015 to June 2017 itself, a total of RM115.8 million in fines and penalties were imposed on institutions for breaching our regulations and affecting the integrity of the financial system. (source: New Straits Times).

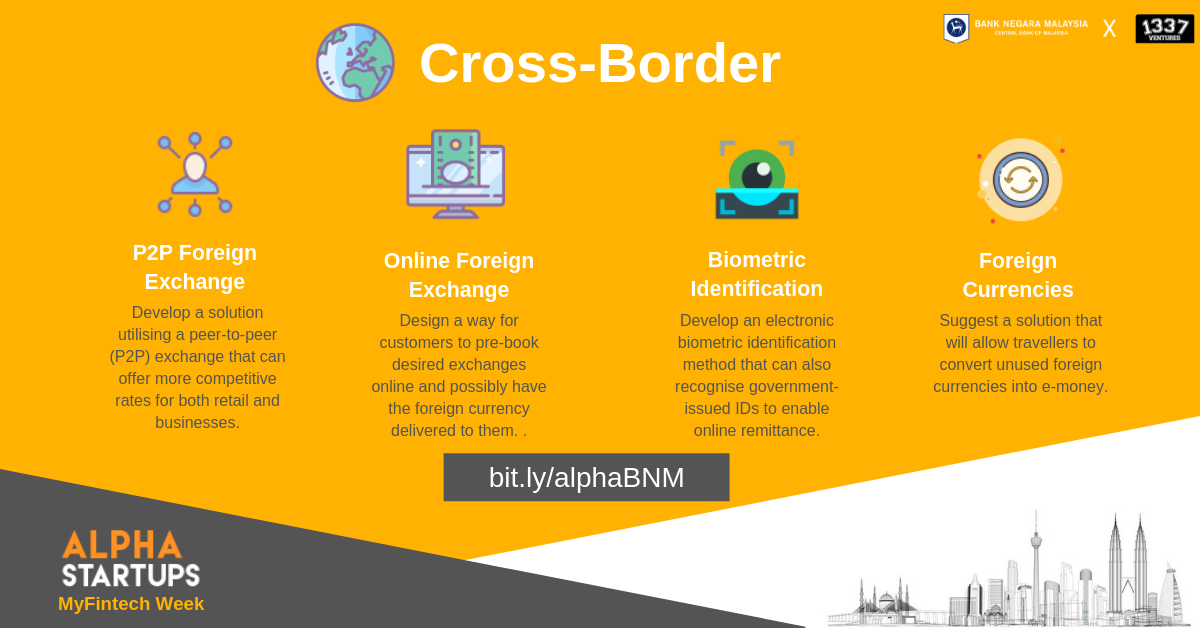

Cross-border

Though there are existing solutions in the cross-border space, there still are pain points that have yet to be relieved totally. Customers are subjected to high exchange rates when purchasing foreign currencies at money changers or any financial institution. Money changers may not have sufficient foreign currency in had to be exchanged with customers.

Though there are existing solutions in the cross-border space, there still are pain points that have yet to be relieved totally. Customers are subjected to high exchange rates when purchasing foreign currencies at money changers or any financial institution. Money changers may not have sufficient foreign currency in had to be exchanged with customers.

Currently, customers are still required to perform face-to-face verification to access remittance services. Furthermore, travellers who do not spend all their foreign currency (in cash) find it difficult to exchange it for their home currency. This is especially true for small denominations and coins.

What is Alpha Startups: MyFintech Week

Alpha Startups: MyFintech Week Edition, powered by 1337 Ventures is an initiative by Bank Negara Malaysia in conjunction with MyFintech Week, a one-week long festival of events with the goal to promote growth and diversity in the fintech ecosystem, spur digital transformation of financial institutions, develop fintech for mutual benefit, and elevate public acceptance of fintech.

The 4-week, intensive programme culminates in a Demo Day in MyFintech Week, a five-day festival by Bank Negara Malaysia to showcase Malaysia’s fintech companies, together with educating the public of new fintech tools. Top teams presenting in demo day will be able to present their pitches to top investors throughout the region. Selected top three teams will receive:-

- RM 150,000 in early-stage funding

- Facilitation by Bank Negara Malaysia through the Fintech Regulatory Sandbox if necessary

- Exclusive packages worth over RM500k, ranging from US$100,000 worth of cloud credits from the likes of Amazon Web Services and Google Cloud

- Special rates and benefits from partner providers such as recruitment platforms and marketing tools

- Free office space for 6 months

Alpha Startups: MyFintech Week is currently looking for innovative ideas throughout Malaysia to solve the problem statements provided by financial institutions and industry leaders, to build solutions for the most pressing pain points in the financial industry.

Successful Alumni

As the first accelerator in Malaysia, Alpha Startups have successfully graduated top startups all over South East Asia. Some notable graduates of Alpha Startups are Funding Societies, who raised SG$10 Million from Sequoia Capital in under 12 months after completing Maybank Fintech (Alpha Startups) and is one of the top performing P2P lending platforms in Malaysia. Another Alpha Startups graduate, AnyPay, was just acquired by Revenue Berhad at a valuation of RM 7 million.

Another notable graduate is live music booking startup Gigfairy that went from idea to acquisition in just 12 months. Gigfairy has since been acquired by Tune Studios and BAC Ventures. Others include Coins.ph, which was recently acquired by GoJek for $72 million, and MaidEasy, that raised an undisclosed 7-digit amount from Axiata 12 months after Alpha Startups.

Applications are now open, and ends on April 29. Apply now at bit.ly/alphaBNM.