You love your startup idea but you need investors like venture capitalists (VCs) to love it too.

How do you convince venture capitalists to buy into your vision and fund your startup?

You do so by building a compelling pitch deck that resonates with them.

A pitch deck is the hook that gets venture capitalists interested in your startup’s potential—it helps articulate your vision and progress and, when done well, can play a huge part in helping you raise funding.

What is it that venture capitalists are looking for in a pitch deck? How do they actually read, evaluate, and process a pitch deck?

In this blog post, we will delve into the key three pillars that venture capitalists look for in a startup’s pitch deck.

The three pillars of a winning pitch deck

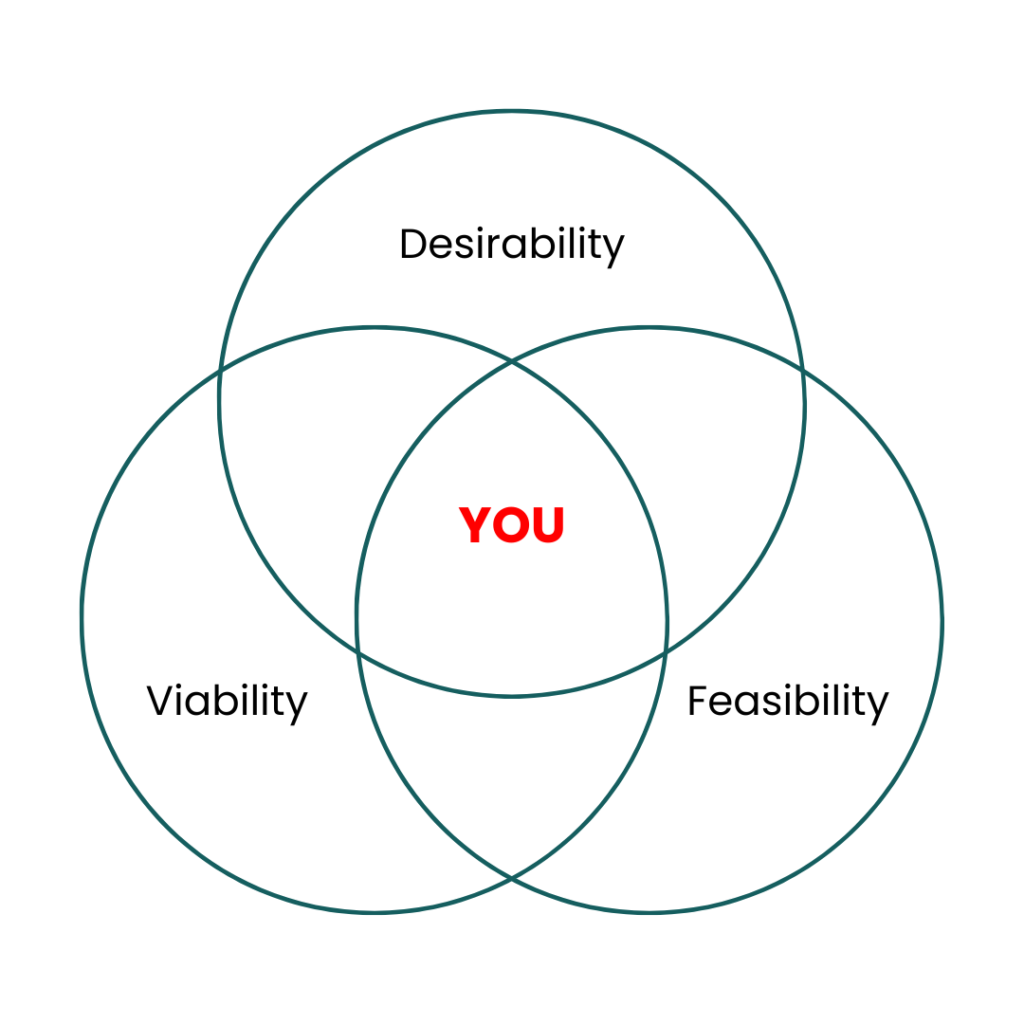

A compelling pitch deck will show that your product or service is desired, feasible, and financially viable. It should clearly show:

- that you are solving the pains of the user.

- the practical and technical capabilities of building the product, and

- the return on investment for the business.

For VCs, these are the key considerations when evaluating the potential success of a new product, service, or business idea. In fact, a successful idea sits at the centre of these three criteria.

Desirability, feasibility, and viability explained

- Desirability: Are you solving the right customer problem?

- Feasibility: The practical and technical capabilities of building the product

- Viability: What is the likelihood that your startup will become part of a sustainable business model?

Desirability

The first box that VCs will check in your pitch deck is desirability.

Desirability refers to the degree to which your startup meets the needs and wants of the intended users. You need to show that your product or service is something someone is willing to pay for or is already paying to use. A need is something your customers cannot live without, while a want is often a more desirable option for fulfilling that need. Both check the box for desirability, but a product that fulfils someone’s need is far more valuable than something someone wants or is “nice to have.

Feasibility

VCs will also look at the feasibility factor, which is the operational capabilities of your startup.

Do you have the hacker, hipster, and hustler to produce and deliver your idea to the market, or do you need a third party that has the technological know-how? If you can deliver your solution by leveraging ~80% of your internal capabilities, then you are on the right path to impressing the VCs. On top of that, VCs will also need to see if you can deliver your solution in a reasonable timeframe and at a price point that ensures you remain viable.

Viability

Viability will tell VCs whether your startup has the ability to be profitable and sustainable over time.

Even if you have the most desirable product or service in the world, if it is not generating revenue and profits, then it may not be a good business model. It is essential that your pitch deck show how your startup makes business sense in the short term and into the future. The quicker and longer you can deliver a positive return on investment, the greater the viability of your startup.

How do you identify these three?

The lean canvas is a business planning method for startup founders who are just starting out.

This one-page document is not cluttered with unnecessary information, making it great to pitch your ideas, key differentiating factors and targets, and so on, to venture capitalists with ease. It focuses on problems, solutions, key metrics, and competitive advantage, helping you optimise your business plan to maximize business value.

The canvas (refer to above) consists of nine structural units or components to help you map the key points necessary to convert your ideas into business plans.

Watch this video for a detailed explanation of the lean canvas: Leet Academy Lean Canvas

Now, it’s time to build your pitch deck

Once you’ve taken the time to fill the lean canvas, you’ll likely see some core information that will make your pitch deck stand out. The following is a checklist of items to include into your startup pitch deck:

If you are ready to create your pitch deck, sign up for Alpha Startups™ Online: a self-paced programme that provides actionable, detailed steps for testing and validating ideas.

And if you already have an idea and a pitch deck, pitch it to us on Pitch Tuesday, where we are always looking for early-stage startups to invest in. Book your slot at: