RHB Banking Group (“RHB” or the “Group”), one of Malaysia’s largest fully integrated financial services group, announced the graduation of seven growth-stage start-ups from its inaugural RHB Xcelerator programme.

The accelerator programme offered mentorship to fintech and adjacent vertical start-ups that addresses challenges in insurance distribution, micro banking, customer experience and banking for the future.

The seven start-ups had undergone eight weeks of mentorship and consultations with different business units within the RHB Banking Group, which allowed them to better articulate their collaboration ideas and address gaps in their knowledge. The result was the successful completion of their proof-of-concept designs, leading to a potential collaboration with the banking group.

Upon completion of the programme, RHB organised the RHB Xcelerator Demo Day, where the start-ups had the opportunity to showcase their proof-of-concept design to a panel of RHB Senior Leaders, including the Group Managing Director/Group Chief Executive Officer, Mohd Rashid Bin Mohamad, Group Chief Strategy and Innovation Officer, Ryan Teoh, Managing Director of Group Community Banking, Jeffrey Ng Eow Oo, and Group Chief Technology Officer, Wong Kwang Leh.

The Demo Day was also attended by the Managing Director of Group Wholesale Banking, Syed Ahmad Taufik Albar, Group Chief Compliance Officer, Fazlina binti Mohamed Ghazalli and the Group Chief Marketing Officer, Abdul Sani bin Abdul Murad.

Ryan Teoh, Group Chief Strategy and Innovation Officer, is hopeful about the outcomes of the RHB Xcelerator Demo Day. “At RHB, we strongly believe that collaboration is a crucial component in pioneering innovation and maintaining our competitiveness as a key financial services group within the industry. To this end, we are certain that the Xcelerator programme will lead towards re-energising the industry, as it allows us to further foster a space for collaboration with diverse and promising start-ups across Southeast Asia, and ultimately facilitate the adoption of their innovative ideas into Malaysia’s financial scene.”

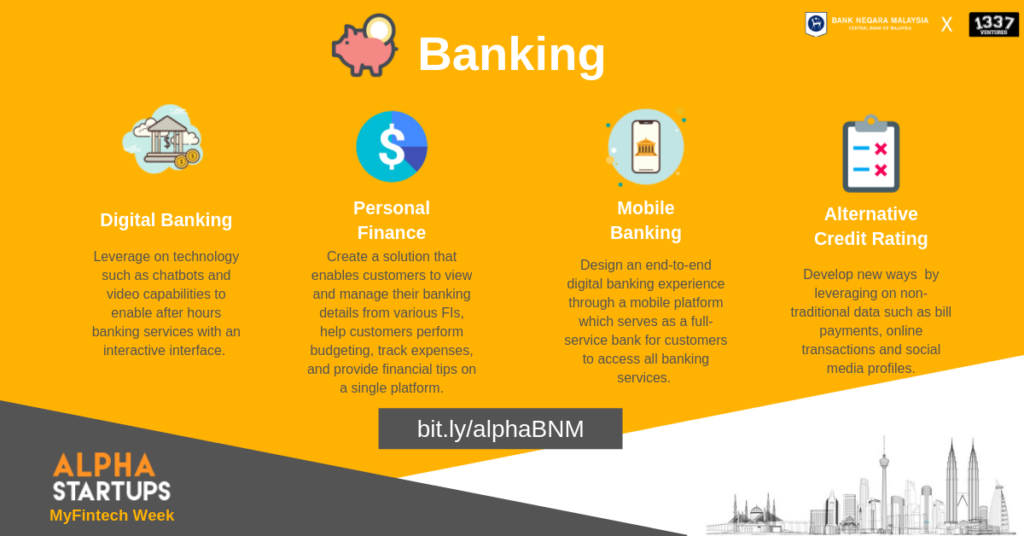

RHB had partnered with 1337 Ventures for their first-ever corporate accelerator to help them access start-ups around the ASEAN region and catalyse innovations with them.

1337 Ventures actively seeks promising start-ups in Southeast Asia and provides them with investment support and subject matter expertise to guide them towards success. The RHB Xcelerator programme is the culmination of more than a decade’s worth of work providing support for start-ups in the region through their award-winning accelerator programme.

Bikesh Lakhmichand, CEO and Founding Partner of 1337 Ventures, expressed his admiration for the various units in RHB Banking Group.

“Their active engagement, insightful discussions, and willingness to scrutinise, challenge, and assist have been key in refining these concepts. They have truly embodied the spirit of co-creation and proven that the future of banking lies not in solitude but in cooperation,” he added.

The seven companies that showcased their solutions during RHB Xcelerator Demo Day were:

Agiliux is a single platform for banks (bancassurance) to manage all their retail channels, integrated with insurers and a common customer helpdesk. They have proposed using an interactive AI chatbot for claim submission, replacing tedious forms, and eventually moving other customer experiences to a superior chat-based experience.

Moby Pay is an app used to make online or offline payments with a QR code. Through a Buy Now, Pay Later (“BNPL”) service, payment can be deferred for two, three, or six months. Their proprietary scoring model has kept defaults very low. Globally, the BNPL market is estimated at US$16 billion in 2022, growing at 22% p.a. Moby Pay has proposed instant settlement under its payments and for RHB to provide a credit line to fund its BNPL.

Payrecon provides an enterprise resource planning (“ERP”) system for Power Sellers to manage sales and inventories, unified across all major e-commerce platforms, and Point of Sales (“POS”) for offline sales. They currently have over 10,000 sellers and had a gross merchandise value (“GMV”) of RM 3.3 billion in 2022-2023. Payrecon has proposed for RHB to provide inventory financing to Power Sellers through their platform.

Protos Labs is an insurtech company focused on cyber insurance currently operating in the Malaysian insurance sector. Globally, the cyber insurance market is worth US$11 billion and growing at 21% p.a. Protos Lab has proposed for RHB to enter the retail cyber insurance market with their end-to-end cyber insurance service.

The Woke Company is based in Brunei/Singapore and provides digital financial education content and programmes in seven countries. Financial education is relevant across many areas in a large financial services group, as finance is often hard to understand for laypeople. Woke has proposed partnerships with RHB associated with debit cards for public university students, saving for children under family banking, stock and unit trust investing, and insurance.

TrinityEco builds sustainability reporting systems for hospitals, data centres, and commercial properties with their AI powered platform, Trivity. The green financing market size is US$3,650 billion and growing at 20% p.a. TrinityEco has proposed to white-label their self-assessment tool for RHB SME customers to obtain a sustainability rating prior to applying for RHB’s green financing products.

Vircle helps parents raise financially smart kids through a first of its kind parental oversight and control e-wallet enabling children to learn to earn, spend, and save safely. They are approaching 50% of the market share of private and international schools in Malaysia. Through RHB, Vircle is looking to strengthen their payment, settlement, and money movement systems and channel school fee collection and financing to RHB. Ultimately, Vircle aims for their partnership with RHB to make RHB the family banking choice of Malaysians.